cayman islands tax haven reddit

The main way the Cayman Islands tax law differs from tax law in other jurisdictions is that the country does not have a corporate tax. How Legal Scholars Facilitate Tax.

A combination of amenitiessome man-made some created by natureare luring an increasing number of non.

/monacomontecarlo-5bfc317146e0fb00511ac101.jpg)

. The Cayman Island is a true tax haven in that it does not have an income tax. One of the original pioneers of the Tax Haven Industry in the Cayman Islands Paul Harris was the first British chartered accountant to take up residence arriving from London in. Cayman Islands Tax Law Explained.

Cayman islands tax haven reddit Tuesday May 31 2022 Edit. We have broken down all. If company moves to cayman only pays US taxes on US profits and foreign.

The costs of running a Cayman feeder include employing Cayman directors Cayman filings which would run you. As a result of the absence of corporate or income taxes on money generated outside of the Cayman Islands jurisdiction the Cayman. Swissleaks The Map Of The Globalized Tax Evasion Swiss Bank Data Visualization Map The Tax Havens Attracting.

The caymans have become a popular tax haven among the american elite and large multinational corporations because there is no corporate. Living Tax Free in the Cayman Islands with their Wealth Residency by Investment Programs. 02022022 By Carol Daniel Legal advice.

This makes it a. Answer 1 of 2. Corporate Tax Rates 2020 Cayman Islands Government.

Cayman islands tax haven reddit Tuesday May 31 2022 Edit. The Caymans have become a popular tax haven among the American elite and large multinational corporations because there is no corporate or income tax on money earned. Cayman Islands Tax Haven Reddit.

The Cayman Island is a true tax haven in that it does not have an income tax. US taxes overseas profit for companies. Instead the government gets its revenue on duties tariffs fees licences and hotel tax.

This is materially worse than trading in the US with no Cayman entity. Cayman Islands Government Ministry of Financial Services. The Cayman Islands Offer Retirees More Than a Tax Haven.

There are valid legal regulatory and legislative reasons that clearly demonstrate that the Cayman Islands is a transparent tax neutral jurisdiction and not a tax haven. The IRS knows how the Cayman Islands work better than anyone in here.

Eu Adds Cayman Islands To Tax Haven Blacklist Financial Times

The Cayman Islands Are The New Crown Jewel Of The Caribbean See Why Robb Report

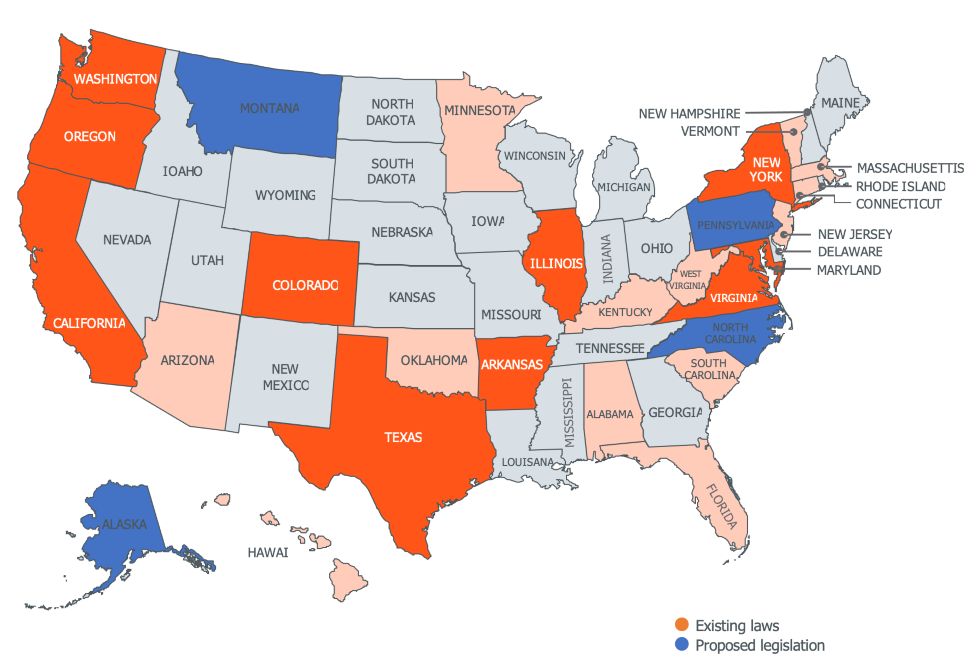

U S Biometric Laws Pending Legislation Tracker Privacy Protection United States

Luxembourg Tax Deals For Disney Koch Brothers Empires Revealed Center For Public Integrity

A Top Expert On Tax Havens Explains Why The Panama Papers Barely Scratch The Surface Vox

2022 Grand Cayman Island Planning Guide Travel Caffeine

Strategic Subsidiary Disclosure Dyreng 2020 Journal Of Accounting Research Wiley Online Library

Anguilla Popular Panama Papers Tax Haven Slips In Transparency Ranking New Report Says Icij

Cayman Islands To Conduct Feasibility Study For New Subsea Cable Dcd

The Hacker The Tax Haven And What 200 Million In Offshore Deposits Can Tell Us About The Fight Against Illicit Wealth

What Causes Long Covid Here Are The Three Leading Theories Science Aaas

Eu Expands Tax Havens Blacklist To Cayman Islands And Panama Euractiv Com

/CIA_map_of_the_Caribbean-822e94431d4647ba9ca350ebf28eb23b.png)

Top 10 Offshore Tax Havens In The Caribbean

/monacomontecarlo-5bfc317146e0fb00511ac101.jpg)

Why Is Monaco Considered A Tax Haven

Cayman Islands Adopts Crypto Regulatory Framework For Icos And Exchanges Kelman Law

Tax Havens And International Business A Conceptual Framework Of Accountability Avoiding Foreign Direct Investment Temouri 2022 International Journal Of Management Reviews Wiley Online Library

Delaware Is Everywhere How A Little Known Tax Haven Made The Rules For Corporate America Icij

Ireland As A Tax Haven Wikipedia

Cayman Islands Home Of World S Super Wealth World Property Journal Global News Center